Press Release

How To Navigate The Bear Market To Make Low Risk Gains With Crypto Trading Bots

Crypto arbitrage trading is a type of trading strategy where investors capitalize on slight price discrepancies of a digital asset across multiple markets or exchanges. In its simplest form, crypto arbitrage trading is the process of buying a digital asset on one exchange and selling it (just about) simultaneously on another where the price is higher.

Doing so means making profits through a process that involves little or no risks. The other great thing about this strategy is you don’t have to be a professional investor with an expensive set-up in order to begin arbitrage trading.

What is arbitrage trading?

Arbitrage has been a mainstay of traditional financial markets long before the emergence of the crypto market. And yet, there seems to be more hype surrounding the potential of arbitrage opportunities in the crypto scene.

This is most likely because the crypto market is renowned for being highly volatile compared to other financial markets. This means crypto asset prices tend to deviate significantly over a certain time period. Because crypto assets are traded globally across hundreds of exchanges 24/7, there are far more opportunities for arbitrage traders to find profitable price discrepancies.

All a trader would need to do is spot a difference in the pricing of a digital asset across two or more exchanges and execute a series of transactions to take advantage of the difference.

For example, let’s assume the price of bitcoin is $45,000 on the Coinbase cryptocurrency exchange and $45,200 on Kraken. In this scenario, crypto arbitrageurs might spot this disparity and buy bitcoin on Coinbase and sell it on Kraken to pocket the $200 price difference. This is a typical example of a crypto arbitrage trade.

Types of crypto arbitrage strategies

There are several ways crypto arbitrageurs can profit off of market inefficiencies. Some of them are:

Cross-exchange arbitrage: This is the basic form of arbitrage trading where a trader tries to generate profit by buying crypto on one exchange and selling it on another exchange.

Spatial arbitrage: This is another form of cross-exchange arbitrage trading. The only difference is that the exchanges are located in different regions. For example, you could capitalize on the difference in the demand and supply of bitcoin in America and South Korea using the spatial arbitrage method.

Triangular arbitrage: This is the process of moving funds between three or more digital assets on a single exchange to capitalize on the price discrepancy of one or two cryptocurrencies. For example, a trader can create a trading loop that starts with bitcoin and ends with bitcoin.

A trader could exchange bitcoin for ether, then trade the ether for Cardano’s ADA token and, lastly, convert the ADA back to bitcoin. In this example, the trader moved their fund between three crypto trading pairs – BTC/ETH → ETH/ADA → ADA/BTC. If there are discrepancies in any of the prices of the three crypto trading pairs, the trader will end up with more bitcoin than they had at the beginning of the trade. Here, all the transactions are executed on one exchange. Therefore, the trader does not need to withdraw or deposit funds across multiple exchanges.

Why is crypto arbitrage considered a low-risk strategy?

You might have noticed that, unlike day traders, crypto arbitrage traders do not have to predict the future prices of bitcoin nor enter trades that could take hours or days before they start generating profits.

By spotting arbitrage opportunities and capitalizing on them, traders base their decision on the expectation of generating fixed profit without necessarily analyzing market sentiments or relying on other predictive pricing strategies. Also, depending on the resources available to traders, it is possible to enter and exit an arbitrage trade in seconds or minutes. Bearing these in mind, we can therefore conclude the following:

The risk involved in crypto arbitrage trading is somewhat lower than other trading strategies because it generally does not require predictive analysis.

Arbitrage traders only have to execute trades that last for minutes at most, so the exposure to trading risk is significantly reduced.

Why is crypto arbitrage considered a low-risk strategy?

You might have noticed that, unlike day traders, crypto arbitrage traders do not have to predict the future prices of bitcoin nor enter trades that could take hours or days before they start generating profits.

By spotting arbitrage opportunities and capitalizing on them, traders base their decision on the expectation of generating fixed profit without necessarily analyzing market sentiments or relying on other predictive pricing strategies. Also, depending on the resources available to traders, it is possible to enter and exit an arbitrage trade in seconds or minutes. Bearing these in mind, we can therefore conclude the following:

The risk involved in crypto arbitrage trading is somewhat lower than other trading strategies because it generally does not require predictive analysis.

Arbitrage traders only have to execute trades that last for minutes at most, so the exposure to trading risk is significantly reduced.

How to start arbitrage trading

Whether you’re a beginner trader or a veteran investor, the great thing about crypto arbitrage trading is there are a number of platforms available today which automate the process of finding and trading price discrepancies across multiple exchanges. These “set it and forget it” platforms can offer a great passive income opportunity for traders who are looking for a low-risk, hands-off trading solution.

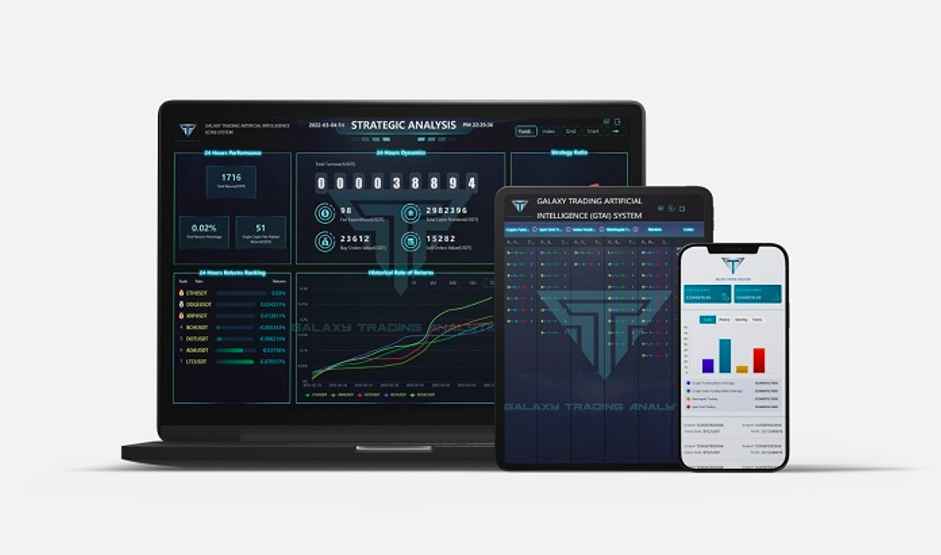

Today, we will be sharing about GTAI Trading Bot, a world-class AI trading plus arbitrage system designed to help crypto traders maximize trading profits while minimizing risks and losses.

Galaxy Trading Analytics (GTA) is a leading regulated Fintech company founded in 2022 by a team of AI and Deep Learning experts. They have constructed GTAI Trading bot, a clear and transparent system that conducts trading transactions according to the parameters set, and have connected investment tools and financial protection algorithms to it. There are currently 4 proprietary trading and arbitrage strategies implemented, with more trading strategies that are currently being developed and will be added to GTAI once more stringent tests are being done.

Traders can choose between two Packages, A or B in their user-friendly App, where in Package A, the only thing traders need to do is set perimeters of the AI Bot and let the Bot do its work, while traders control 100% of their funds in their crypto exchange accounts. Traders’ monthly estimated gains could be between 2% to 8% depending on crypto market conditions.

Traders can also go for Package B, where traders will get access to a dedicated team to monitor their trading on their behalf, deploying the right strategies according to the market movement. There will also be active risk management in place, 24 hours a day. Package B also grants access to higher leverage using liquidity pools, which means higher and more consistent profits by more powerful AI bot, going between 3% to 36% monthly gains. Both options can be selected at the same time, they are suitable for beginners, advanced or expert traders, and participation start from as low as $100.

Visit their website to find out more about their services and capabilities.

-

Press Release4 years ago

Press Release4 years ago5 best crypto exchanges of 2022

-

Press Release5 years ago

Press Release5 years agoBlockchain Applications made Simpler with Dappatoz

-

Press Release5 years ago

Press Release5 years agoMeet TABOO, the unique token that gives reward for every transaction

-

Bitcoin7 years ago

Bitcoin7 years agoBitcoin’s Gravity: How Idea-value Feedback Loops Are Pulling People in

-

Press Release5 years ago

Press Release5 years agoCloud Mining: How Multimine is Making Crypto Mining Operation More Seamless.

-

Press Release5 years ago

Press Release5 years agoSHA-256 – The best combination of Bitcoin mining, Cloud, and affordable Hash Power

-

Press Release7 years ago

Press Release7 years agoLISTING OF LEVL ON A SECOND EXCHANGE

-

Press Release6 years ago

Press Release6 years agoEXMR FOUNDATION NETWORK “LABS OF DAPPS & PROJECTS” MORE INFO.